ROCKET COMPANIES STOCK PLUS

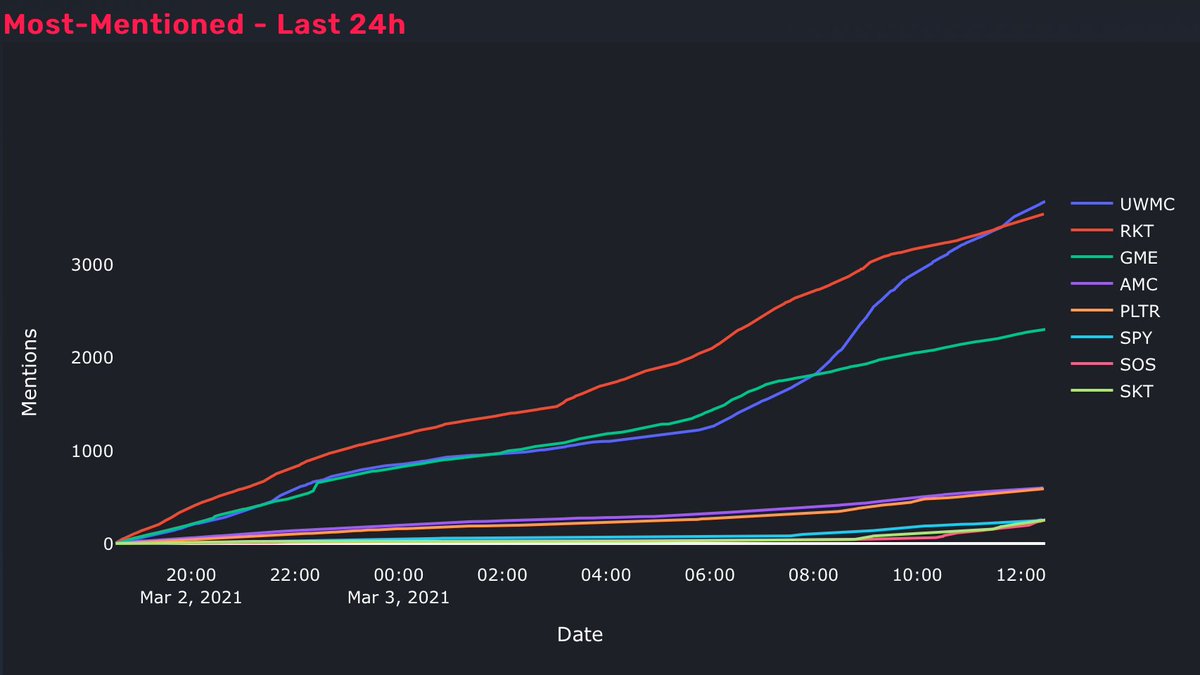

Class A (RKT:US), plus the latest news, recent trades, charting, insider activity, and analyst ratings. On the date of publication, David Moadel did not hold (either directly or indirectly) any positions in the securities mentioned in this article. Get the latest stock price for Rocket Companies Inc. If these predictions pan out, there just might be a turnaround moment - and even a rocket ride to the upside - for RKT stock in the coming year. DETROIT, J- Rocket Mortgage, Americas largest mortgage lender and a part of Rocket Companies (NYSE: RKT), today announced the introduction of Rate Drop Advantage an exclusive program that brings confidence to homebuyers by covering a significant portion of closing costs of a refinance transaction if interest rates drop and. Moreover, the analyst expects Rocket’s market share to reach 6.7% in 2023. Moreover, the analyst expects Rocket’s market share to reach 6.7. With that, he raised his 2023 earnings per share (EPS) estimate for Rocket Companies from 65 cents to 75 cents.

Gordon 1.96K Follower s Summary The mortgage origination downcycle has several years to run, with lots of excess capacity. Anticipating that Rocket Companies could benefit from dislocation in the residential-mortgage market, Fandetti foresees a better risk/reward for RKT stock. With that, he raised his 2023 earnings per share (EPS) estimate for Rocket Companies from 65 cents to 75 cents. 23, 2021 6:37 PM ET Rocket Companies, Inc. Fandetti sees negative sentiment peaking as well as margins starting to stabilize and even grow.Īnticipating that Rocket Companies could benefit from “dislocation” in the residential-mortgage market, Fandetti foresees a “better risk/reward” for RKT stock. Could there be a potential buying opportunity here? Wells Fargo analyst Donald Fandetti seems to think so. In order to justify its current price of 21/share, Rocket Companies must achieve a 14 NOPAT margin (average of all Consumer Lending firms that earn a positive margin, compared to Rocket.

ROCKET COMPANIES STOCK REGISTRATION

If and when the merger is completed, we’ll revisit the prospect of owning a pure-play rocket company stock. Rocket Companies (RKT) aims to raise 3.15 billion from the sale of its Class A common stock in an IPO, according to an amended registration statement. With that, however, Rocket’s trailing 12-month price-to-earnings (P/E) ratio has declined to an enticing 4.6. Rocket Lab, a leading space rocket company primarily serving the small satellite market, released a 700-plus-page document that spelled out the risks (many) and losses (substantial) the company is facing. RKT stock has been heading toward a crash landing over the past year, falling from a 52-week high of around $19 to just $8 and change.

ROCKET COMPANIES STOCK UPGRADE

All Rights Reserved.This upgrade couldn’t have come at a better time for Rocket Companies’ struggling investors. Immediately following the report, RKT jumped more than 15 basically what you’d expect from impressive post-IPO earnings these days. Our launch of the Rocket Mortgage online platform in 2015 revolutionized the mortgage. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment tools. The only real bit of news was Rocket’s rather impressive fourth-quarter earnings report on February 25 which included a special dividend of 1.11 per share. All content of the Dow Jones branded indices © S&P Dow Jones Indices LLC 2019 and/or its affiliates. A high-level overview of Rocket Companies, Inc.

Standard & Poor's and S&P are registered trademarks of Standard & Poor's Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN. Chicago Mercantile Association: Certain market data is the property of Chicago Mercantile Exchange Inc. Factset: FactSet Research Systems Inc.2019. View the best growth stocks for 2022 here. RKT stock is rocketing higher today as a big bank analyst expects Rocket Companies to prevail despite difficult market conditions. Since then, RKT stock has decreased by 45.6 and is now trading at 7.61. Rocket Companies Announces First Quarter Results - Grew revenue, net to 4.6 billion, up 236 year-over-year - Increased Adjusted Revenue to 4.0 billion, up 91 year-over-year¹ - Grew net income. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes. Rocket Companies' stock was trading at 14.00 on January 1st, 2022.

0 kommentar(er)

0 kommentar(er)